Get Your Clutter in Order When You Get ISM Help with Sage 100 Payroll

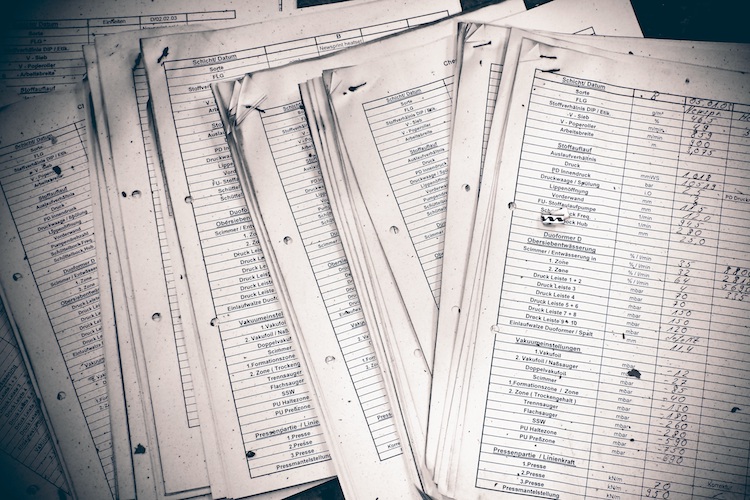

Managing employee payroll in Sage 100 can take quite a while to figure out, and the small payroll mistakes you make while you’re learning can have high consequences, such as alienating employees with late paychecks or incorrectly withdrawing taxes. The complexity of hiring, managing, and paying employees can seem like a lot to deal with at times, but since your business is growing and you’ve got all those payroll papers all over your desk already… you may as well figure out a better way to streamline the process.

Sage 100 Payroll helps you keep on track as you simplify your payment and reporting process, and it also helps you manage and understand confusing details like ACA reporting, direct deposit, and W-2 reporting.

Make your payroll process easier. Learn more in next week’s Lunch-n-Learn from ISM. On March 21 at 11:30 AM Pacific, ISM will demonstrate and discuss the Sage 100 Payroll system so you can see how it works. Register here.

Really? There’s an Easier Way to Do Payroll?

If you’ve been struggling to get your paperwork under control and you feel like you’re always missing information for government reporting, we’re here to reassure you: Payroll does get easier. Much easier.

Or, at least it does if you get help from Sage 100 Payroll. This flexible program extends the power of your Sage 100 ERP by automatically calculating accurate deductions and payments for you, and also offers insightful data so you can make better-informed decisions about your workforce.

In addition, Sage 100 Payroll helps with:

- Direct deposit

- ACA reporting

- W-2 reporting

- Tax jurisdictions

- Employee contact data

If you’re interested in completing your payroll electronically in a fraction of the time it takes you to complete manually, you’ll want to consider the upcoming Lunch-n-Learn from ISM.

Get Payroll Help from ISM

Next week’s Lunch-n-Learn offers an in-depth introduction to Sage 100 Payroll, with a focus on the top challenges businesses face in the calculation, deduction, and reporting processes.

Got a tricky payroll question you’ve been wondering about? We encourage questions at our Lunch-n-Learns, so ask away. All our Lunch-n-Learns are here to serve you better.